Vanity Fair Takes Aim at Harvard

Posted on June 30th, 2009 in Uncategorized | 13 Comments »

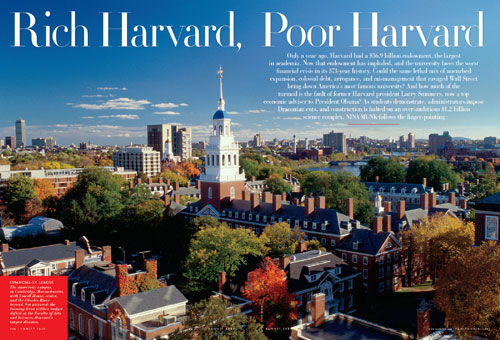

A commenter below brought this Vanity Fair article on Harvard—it’s called “Rich Harvard, Poor Harvard”— to my attention. Sounds juicy—and sensational!

• [Writer Nina] Munk became persona non grata in Cambridge, as Harvard refused to cooperate with her on the story. But speaking on the condition of anonymity, administrators and other officials were happy to snipe back and forth. “Were the judgments we made reasonable ones?” asked a former top Harvard administrator. “At the time, I think they were reasonable judgments. It turns out, with the benefit of hindsight, you might have preferred less ambitious plans.” A member of the board of Harvard Management Company doesn’t buy it. “This story is about leadership. It isn’t about money,” the person said.

The article should hit newsstands tomorrow…

13 Responses

7/1/2024 2:46 pm

Am curious to read the article. Just from the summary, she got one thing right and one thing wrong.

1. “Yet for reasons no one can seem to explain, the university simply forgot to (or chose not to) cancel its swaps. The result was a $1 billion loss.”

She got that right. Who was minding the store?

2. “Two particular annoyances were Summers, who had been questioning Meyer’s investment strategies,…

She got that wrong.

7/1/2024 4:05 pm

No, Sam, she got that right too.

7/1/2024 4:26 pm

No Pioneer 13, she got that wrong, very wrong.

Why don’t you identify yourself and we can have a discussion about it.

7/1/2024 4:41 pm

Who made the billion?

7/1/2024 4:46 pm

On your 1) Sam, I take it she also got right the bit right before your quote starts up, namely:

“The swaps were put in place under former Harvard president Larry Summers in the early 2000s to protect the university against rising interest rates on all the money it had borrowed. Instead, interest rates plunged.”

Since that’s old news, here’s a question for either you, Sam, or Pioneer 13, or anyone else. What entities profited and stand to profit from Harvard’s having failed (through choice or amnesia) to cancel the swaps? So who are Harvard’s creditors in this? Would you include Citi, Bank of America, PIMCO even (directly or indirectly), in the group. I assume there is an answer that can be ascertained.

7/1/2024 4:53 pm

RT,

She got that right.

I don’t know who took the other side of the trade. Could be any number of entities… former I banks, hedge funds, European commercial banks etc.

Why would you mention PIMCO and B of A?

7/1/2024 5:03 pm

And Citi. Just curious. I guess the Vanity Fair article will reveal something of all of this.

7/1/2024 6:21 pm

Something to read while waiting for Vanity Fair:

http://harvardmagazine.com/breaking-news/harvard-layoffs-update-more-reshaping-come

7/1/2024 8:16 pm

Sam,

How can you be so sure about what Larry Summers DIDN’T raise questions about while he was president? I think we can agree that he generally raised a lot of questions about a lot of things. Are you saying that you know for a fact that he never challenged Meyer on his investment strategies? (Obviously I know nothing at all about this stuff except what I read.)

By the way, he is taking a big pay cut, to $172K.

7/2/2024 12:59 am

Harry,

HMC’s investment strategies didn’t change when Larry was president. In fact, there was a huge expansion of the “internal programs” which Meyer “took” with him when he left.

7/2/2024 2:46 pm

Sam, is it enough to say that I heard it directly from Jack?

7/2/2024 3:53 pm

It’s impossible to reply when you don’t identify yourself.

You’re a very intelligent person; that much is clear. You know a lot about the finances of the university. For all I know you could be Jack.

What’s the problem with letting everyone know where you’re coming from? What do you have to lose? If you’re really interested in the subject (s), which you appear to be, what’s the problem?

7/11/2024 4:45 pm

what worries me the most is they aren’t going to serve waffles to the students anymore!!!!!